Merchant ship fleets owned by companies in many countries are benefiting from an upsurge in China’s imports of energy commodities – coal, oil and gas – this year. Despite the Chinese economy’s modest rebound, import demand for these cargoes has proved remarkably strong.

This positive change is especially advantageous for bulk carrier, tanker and gas carrier employment because energy commodity imports into China are a large part of world trade in these commodities which, in turn, comprise over two-fifths of all global seaborne trade. Within the energy segment China’s imports of coal, oil and gas totalled about 830 million tonnes last year, comprising one-sixth of the world volume.

Figures for the first 10 months of 2023 showed large rises. Coupled with assumptions, albeit tentative, about the remaining weeks, the data suggests that in the current year as a whole China may see an increase in seaborne energy imports of as much as 20% or more, compared with the previous twelve months, raising the total to over 1 billion tonnes.

The upturn unfolds

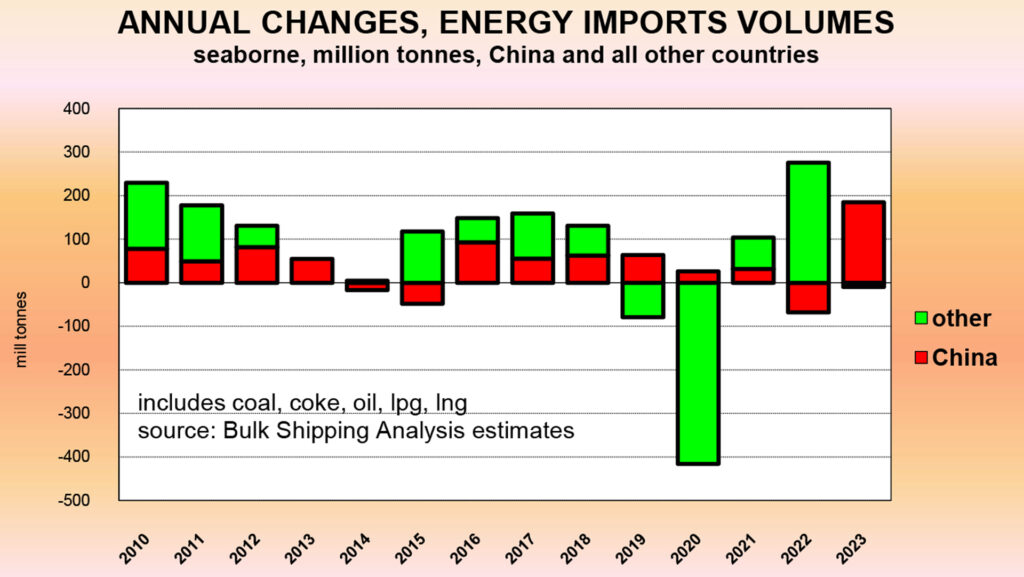

Of significance for the world merchant ship fleet’s employment are signs that China’s imports are contributing all the net growth in global energy commodity imports this year. Other countries’ imports of these commodities seem likely to be flat or perhaps marginally lower, based on provisional calculations.

Looking in more detail at the changes unfolding reveals that coal and crude oil are contributing the largest proportion of China’s energy commodity imports expansion in 2023. Higher coal purchases are a particularly prominent feature. According to official statistics coal imports (mostly seaborne but including some land movements) during the January–October 2023 period were 67% above the total in last year’s same period, at 387 million tonnes. Crude oil imports rose by 14% to 473 mt.

Some of the strength in import demand for energy commodities this year is explained by China’s economic recovery after covid controls were lifted at the end of last year. Through the pandemic economic activity was held back by restrictions, followed by a rebound causing energy demand to increase.

In individual commodities more specific influences are relevant. For example the coal imports surge is partly exaggerated by comparison with last year when imports were abnormally low in the early weeks, reflected in a large fall in the annual 2022 total. Growth this year has been aided by tight supplies in the Chinese market, amid demand outpacing production of coal in domestic mines.

Will growth continue?

Forecasts of China’s commodity import demand have often proved wrong in recent years, partly because (as in many other countries) unfolding events and their impact are hard to predict. But there are various signs of how the trend may evolve in 2024.

Among these pointers, the spectacular expansion of coal import demand to a record high level this year seems unlikely to persist. Recent strength is based on a combination of energy market changes that probably will not be repeated next year. By contrast there is cautious optimism for crude oil and liquefied natural gas imports.

Sustained growth in China’s economy over the next twelve months, albeit potentially at an annual rate lower than seen in many preceding years, can be expected to underpin oil consumption. Yet rapid expansion of electric vehicle use could be a restraining influence.

The outlook for LNG imports is positive, a reversal after last year’s downturn, assuming an upwards gas consumption trend and additional re-gasification capacity under construction beginning to operate. But there is competition from increasing pipeline gas supplies and expanding output of renewable energy.

In its recent ‘World Energy Outlook 2023’ report, the International Energy Agency stated that “China’s growth has defined the energy world in recent decades”. IEA analysts also commented that “its (China’s) economy is changing”, a feature that can be expected to have effects on future energy demand. This view implies substantial repercussions for related commodity import trends and the international shipping markets, into next year and longer term.

Please contact the author if you have any questions or comments, at: [email protected]

Any opinions expressed by contributors do not necessarily reflect the views of the Chinese Shipping Association of London. Content provided are for informational purposes only.